So long 2022! Don’t let the door hit you. You were the worst year for mortgage rates that most of us have seen in our lifetimes in terms of the pace of the rate spike. Sure, our friends who have more “life experience” are happy to remind us about their double digit mortgage rates in the 80s, but that was then, and everything’s relative. Besides, the “2nd worst rate environment, ever” doesn’t really make anyone feel any better.

Perhaps it’s some small consolation to think of 2022 as the bill that came due for the massive housing/mortgage market party that took place in 2021 and much of 2020.

During that time, huge milestones were achieved. The following charts highlight the time from early 2020 through the end of 2021 (in the red boxes) to show just how exceptional it was on several levels.

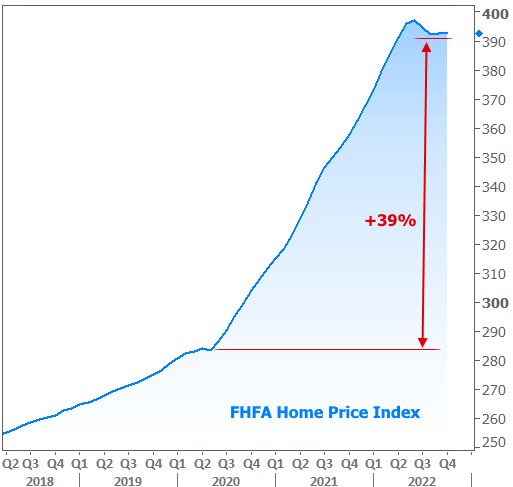

1. The average home appreciated by roughly 40%, even after accounting for the modest correction in prices seen in the past few months.

2. Home sales exploded to levels well above anything else seen during the past decade

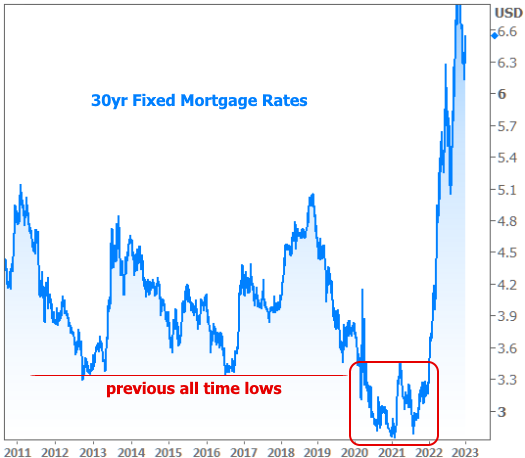

3. Rates plummeted well into new all-time lows and stayed there for much longer than any previous stint.

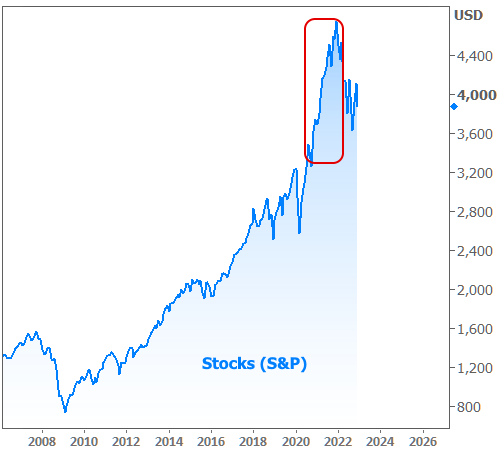

4. Even if we shift gears to the stock market, we find gains of almost 50%. Even after the crummy 2022, stocks are still up roughly 20% from pre-covid levels.

All that to say, yes… 2022 was awful in several ways, but if we add it together with the previous two years and divide by three, some might argue it was a fair price to pay.

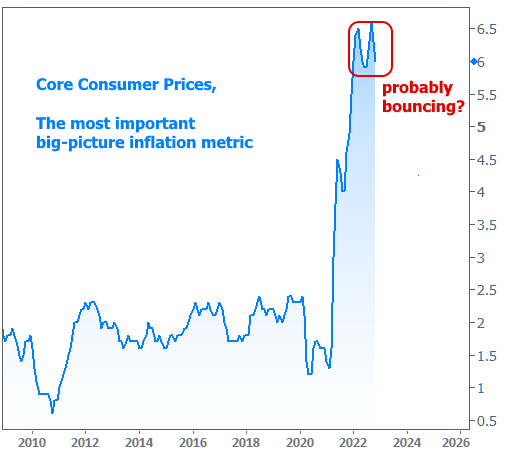

Looking ahead, we’re in a similar position to much of the past few months in that we’re waiting for inflation and economic data to confirm a shift in the forces that pushed rates so abruptly higher this year. There are certainly already signs that shift is at hand.

The Fed has even acknowledged them. But it’s important to remember that the Fed is intently focusing on painful lessons from the past in which rates were cut too early after a potentially similar shift 4 decades ago. They believe it’s better to overtighten (i.e. push rates higher than they really need to go) instead of risk an inflationary rebound and a big 180° on rate hikes as seen in 1981.

The Fed’s bellwether for their ability to keep policy tight will be the strength of the labor market. If people are employed and wages aren’t falling, they’ll conclude that they have what they call “policy room.” In other words, they can keep doing things that hurt the economy and bring down inflation if the economy isn’t showing many symptoms of being hurt. Note: they would only do this seemingly cruel stuff until inflation is firmly in check. At that point, they wouldn’t try to crush the jobs market just to be mean.

The surge in labor costs (including wages and benefits) is a legit problem for them, and it can be seen in the Employment Cost Index data running well above all of the past decade (you’d have to go back to the 80s to see higher levels).

Markets will be closed on Monday to observe the New Year holiday. Market activity will gradually build into the end of the following week, culminating in the important jobs report on Friday. But 2023 will officially begin for the bond market on January 12th with the next release of the Consumer Price Index. This more than anything else, could set the tone for trading in the new year.