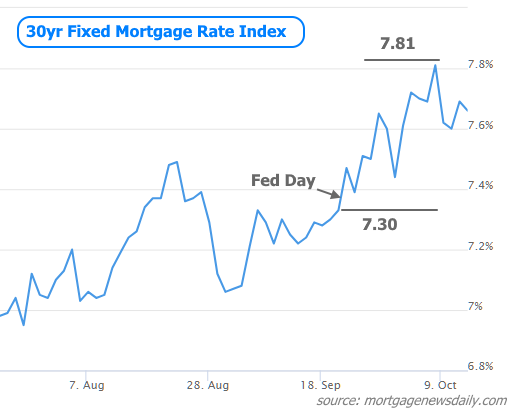

After hitting the highest levels in decades last week, mortgage rates dropped sharply at the beginning of this week. At first glance, this was a classic flight to safety following the outbreak of the Israel-Hamas Conflict, but at the same time, markets were possibly just as interested in a change in tone from the Fed.

The Fed’s last policy announcement was on September 20th and we won’t get the next one until November 1st. Between now and then, the market refines its understanding of the Fed’s stance based on speeches given by regional Fed presidents and/or executive board members.

First off, essentially every Fed speaker qualifies their comments these days by saying something to the effect of: “if the economy and/or inflation run hotter than expected, we may have to hike more.” To be sure, that goes without saying at this point, so we will not say it again, but you can safely assume that it was present in all of the Fed speeches recapped below.

Dallas Fed President Lorie Logan and Fed vice chair Philip Jefferson kicked things off over the 3 day weekend, sharing mixed comments on Monday. Logan said that the recent run-up in long-term rates meant less of a need for the Fed to hike again. Jefferson was even more encouraging, saying:

- We have to balance the risk of not having tightened enough, against the risk of policy being too restrictive.

- In assessing future policy changes, I will keep in mind that financial conditions are tighter due to higher bond yields.

Atlanta Fed President Raphael Bostic delivered some of the more memorable remarks of the week just as bond traders were getting back to the office after Monday’s holiday closure. Here are the highlights:

- Inflation has improved considerably although there’s still more work to do.

- Our current policy stance is restrictive enough to restore 2% inflation.

- Many impacts are yet to be felt

- We don’t need to hike rates anymore

Later that same day, San Francisco Fed President Mary Daly reiterated the notion that the risk of doing too much vs too little was now roughly balanced. Like several other Fed speakers, she also called attention to geopolitical uncertainty as a risk factor for the global economy.

A day later, Boston Fed President Susan Collins echoed the common sentiment that there is a lag between the Fed hiking rates and the economy feeling the effects of those rate hikes. This is just another way for Fed speakers to say they’re probably done hiking.

That same day, Fed Governor Christopher Waller had the following thoughts to share:

- Financial markets are tightening and will do some of the work for us.

- Fed can watch and see what happens on rates.

- In the last 3 months, inflation has been very good.

Not to be outdone, Philadelphia Fed President Patrick Harker sent us into the weekend with a thoughtful and thorough recap of where we are and where we may be going. It deserves a verbatim quotation: “Absent a stark turn in what I see in the data and hear from contacts, both in one-on-one conversations and in forums like this, I believe that we are at the point where we can hold rates where they are. Look, we did a lot, and we did it very fast.”

It is very rare to see this volume of Fed speeches with such a unified theme in cases where that theme represents a shift from the prevailing messaging. Granted, this isn’t an immense shift, but it’s an important one. Up until this week, our takeaway from the Fed is that there was still more work to do on inflation and that we’d probably get another rate hike this year. Now at the end of this week, we’re left with the impression that “more work” is already being done by previous hikes and by the bond market’s response to September 20th Fed announcement (mortgage rates rose half a percent by last week!).

It’s so rare and so obvious, in fact, that the market clearly reacted. How do we know it wasn’t just a “flight to safety” (the jargon term for investors buying safer assets like US Treasuries and selling riskier assets like stocks) surrounding the Israel/Hamas Conflict?

We can’t rule that out as an important consideration for financial markets. After all, it was even mentioned by several of this week’s Fed speakers. But ultimately, a true flight to safety involves the selling of stocks (or at the very least not the simultaneous buying of stocks and bonds), and that’s not what happened this week. In fact, there was quite a bit of that “simultaneous buying,” and that’s a trading pattern most often seen when the market is cheering for friendlier Fed policy.

As glad as we are to see and hear this shift from the Fed, a word of caution: they are not kidding when they offer caveats about potentially needing to hike more if inflation or economic growth do better than expected. Harker will be the first to tell you: “I really do not expect it, but if inflation were to rebound, I know I would have no hesitancy to support further rate increases as our objective to return inflation to target is, simply, not negotiable.”

In other words, this shift is good, but it’s only as good as the data that supports it. That means we must continue watching and waiting for key signals in key reports. For example, this week’s CPI (the Consumer Price Index) showed a surprising uptick in services inflation, one of the sectors the Fed is watching most closely. Rates immediately jumped and never made it back to pre-CPI levels.

There aren’t any reports that are as important as CPI in the week ahead, but several could come close if they fall far enough from forecasts. That said, the biggest moves in rates will require a unified message across multiple reports, and that would have to include the next jobs report which isn’t due out until November 3rd.