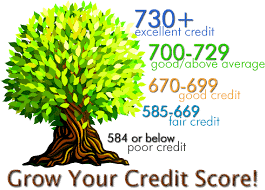

Your Credit Scores – Understand them & see how YOU can improve them

The New Year is upon us and now may be the best time for you to learn what goes into making up your credit scores and see how you can improve them in order to get your credit back on track. It appears that credit agencies have been trying to keep you in the dark about how your scores are developed, often leaving you frustrated and discouraged. This article will show you that with some insight into the credit score world, some determination on your part, and a little help from me, 2020 can be the year to get your credit back on track.

Your credit scores are derived from the following five characteristics of your credit history:

Payment History – 35% of your total credit score comes from how you make your payments. When you make a payment more than 30 days past the due date, your scores drop. Those occasional “late payments” add up and they lower your scores. Let me show you how you can easily avoid late payments.

Payment History – 35% of your total credit score comes from how you make your payments. When you make a payment more than 30 days past the due date, your scores drop. Those occasional “late payments” add up and they lower your scores. Let me show you how you can easily avoid late payments.

Account Balances – 30% of your total credit score comes from comparing your outstanding balances with the Credit Limits set by the lender. Lenders want to see that you are able to keep your balances to approximately one-third of the Credit Limit. If the Credit Limit on your credit card is $5,000 and your balance is $4,000, your balance is 80% of the Credit Limit which will drop your credit scores. Let me show you how you can easily avoid going over your Credit Limit.

Length of Credit History – The length of time you have had your accounts opened represents 15% of your credit score. Naturally, a lender wants to be able to see that you are responsible for the credit you have so if the accounts showing on your Credit Report are new, then it is difficult to verify a history of their use. Let me show you an easy way to help you build a credit history.

Types of Credit – The types of credit accounts that you have represent 10% of your credit score. It is necessary to have both Installment Loans and Revolving Credit accounts in order to have a diversified Credit Report. Let me show you have to vary your credit accounts in order to optimize your credit scores while “setting-them-and-forgetting-them” until they’re paid off.

Applying for New Credit (Inquiries) – Credit Inquiries represent the last 10% of your credit score. Each time you apply for credit, the company that you apply to pulls your credit report and there is a history of them looking at your credit in the form of an “Inquiry”. Let me show you the best way to apply for credit in order to minimize inquiries.

Give me a call at 203-668-7770 and let me show you some easy ways to quickly “Grow Your Credit Scores” today. Buying a home may not be as far away as you might have thought it was. Call today!

Dotty Owens

203-668-7770

NMLS# 70977

Northeast Financial, LLC (Company NMLS: 117273)