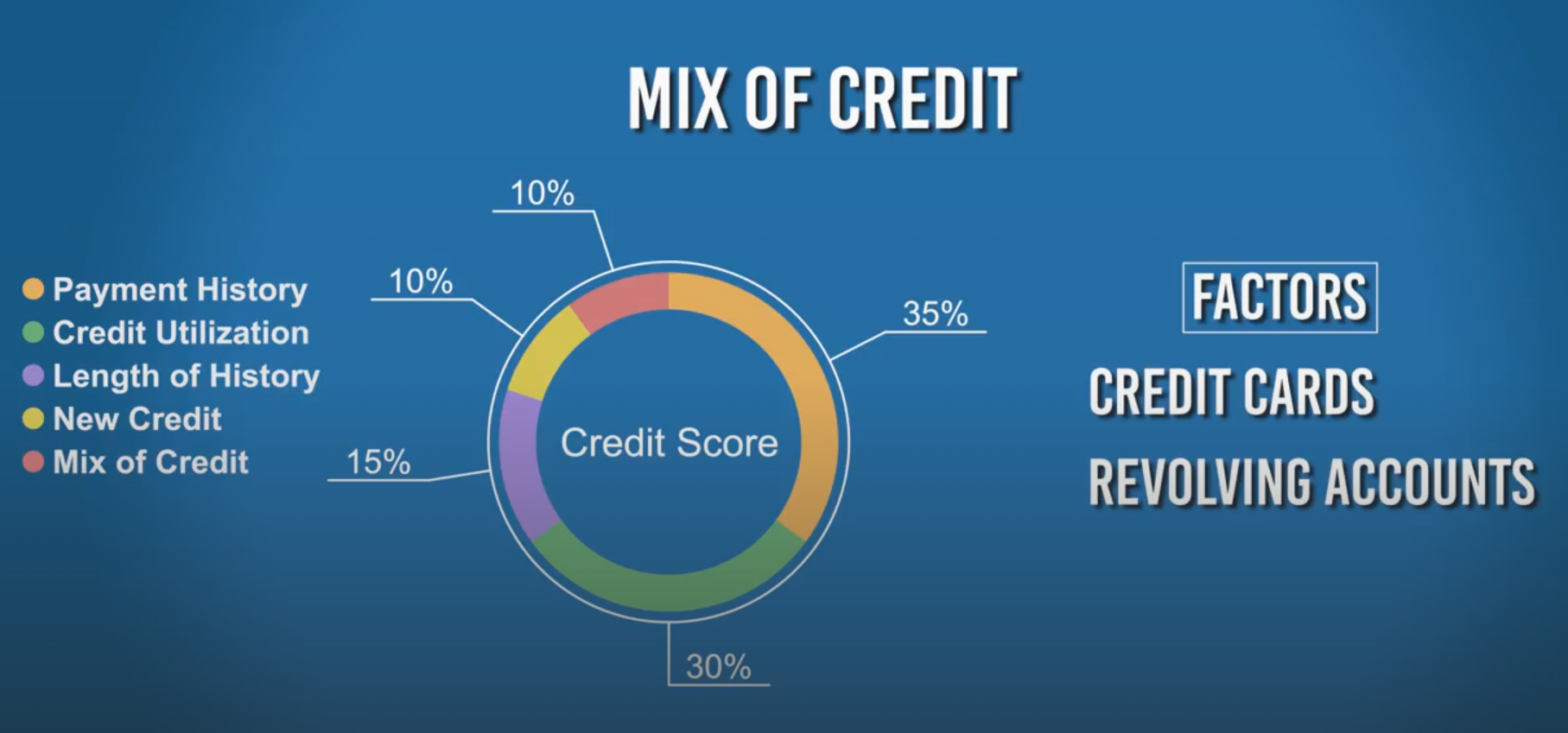

When it comes to credit scores, many people focus on payment history and amounts owed. However, the types of credit you use—known as your “credit mix”—also play a role in determining your score. In fact, credit mix accounts for about 10% of your FICO® Score

What Is Credit Mix?

Credit mix refers to the variety of credit accounts you have, such as:

Revolving credit: Credit cards, retail store cards, and lines of credit.

Installment loans: Mortgages, auto loans, student loans, and personal loans.

Lenders like to see that you can handle different types of credit responsibly. A diverse credit portfolio suggests that you have experience managing various financial obligations.

Why Does Credit Mix Matter?

While credit mix is a smaller component of your credit score compared to payment history (35%) and amounts owed (30%), it still influences your overall score. A healthy mix of credit types can indicate to lenders that you’re a well-rounded borrower.

However, it’s important not to open new credit accounts solely to improve your credit mix. Each new application can result in a hard inquiry, which may temporarily lower your score. Instead, focus on maintaining a balanced mix of credit that suits your financial needs.

Tips for Managing Your Credit Mix

Don’t open unnecessary accounts: Only take on new credit when needed.

Maintain existing accounts: Keep older accounts open to show a longer credit history.

Pay all accounts on time: Consistent, timely payments across all credit types are crucial.

Remember, a good credit mix is just one part of a healthy credit profile. By managing your debts responsibly and making timely payments, you’ll be on the right track to maintaining a strong credit score.