One of the most important components of a prospective homebuyer’s offer is the Pre Approval Letter. As our culture has evolved to a have-it-now mentality some online lenders have begun to take shortcuts. These online lenders and banks have started to issue pre-approval letters simply to win over a borrower’s business without really doing a thorough job. When going through the process to get pre-approved to buy a home many factors are expected to be verified in advance of a prospective buyer putting in an offer. It is the lender’s responsibility to ensure that a borrower is qualified for a mortgage loan they have applied for. The expectation should be that the lender has reviewed income, assets, and credit prior to issuing that pre-approval letter. When this has happed one should feel confident that not only will their offer be taken seriously but also that once they have an accepted offer they should feel very confident that their mortgage loan will be approved by the end lender as expected.

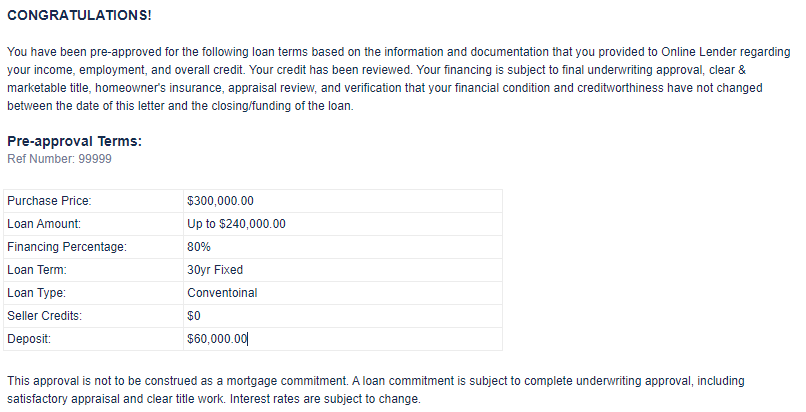

Let’s take a look at what is happening. Some online lenders will issue a 2 or 3 page pre-approval letter but… the realtor only sees the last page.

What is on this last page?

Example Below:

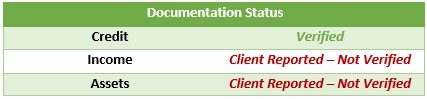

What is missing and NOT visible to the realtor?

What was verified actual by the lender prior to issuing this pre-approval.

Why is this important?

If the lender did not review income, credit, and assets how do they really know the borrower will qualify for that loan. Most borrowers do not underwrite loans for a living or buy homes every year so they will not know what is required to be reviewed.

There are a lot of items that can come up along the way that can derail a transaction. What if there is a loan deduction or garnishment on the paystubs for a loan that does not appear on your credit? This could affect the Debt to Income Ratio which could make it so the borrower no longer qualifies for the home they just put an offer in on. What if the funds the borrower is using for the down payment are currently held in cash? Most lenders will not allow cash to be used as a down payment without it being seasoned in the bank for a period of time which could be as much as 60 days in some cases. If your contract is expected to close before the money has seasoned in the bank then that buyer may end up losing the home.

Worst of all the borrower’s hard-earned initial deposit funds could be put at risk for failure to close on time or at all per the contract terms.

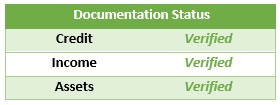

What should you always expect from your mortgage professional when you are being pre-approved?

- Your credit has been reviewed with a valid tri-merge mortgage credit report

- Your income has been reviewed and validated by your loan officer

- Your residence and job history over the last 2 years have been reviewed by your loan officer

- Your down payment funds have been reviewed and verified by your loan officer

- Current mortgage pricing and closings costs have been run and reviewed by your loan officer

- Taxes and Insurance for the property you are putting an offer in has verified and included in your debt to income ratios (Condo and homes located in planned developments may also have association fees associated that need to be taken into account)

- Finally, all of your information has been reviewed by a lender or run through an automated underwriting engine verifying you qualify under the terms as presented on your offer letter.

Even though some lenders will send out a pre-approval based on a loan application and credit report it may not be a good idea to use it. Always make sure that your lender has verified your information before using that pre-approval.

Ready to take the first step in homeownership? Call Northeast Financial LLC today to speak to one of our licensed mortgage professionals for a “Verified Pre-Approval”.