At Northeast Financial, we understand how confusing credit scores can be—especially when the score you see on apps, bank statements, or credit card accounts doesn’t match the one your lender pulls during a mortgage application. If you’ve experienced this discrepancy, rest assured it’s completely normal and happens for a good reason.

Different Scoring Models for Different Purposes

Credit scores are calculated using various scoring models, each tailored to specific financial products. Here’s a quick breakdown:

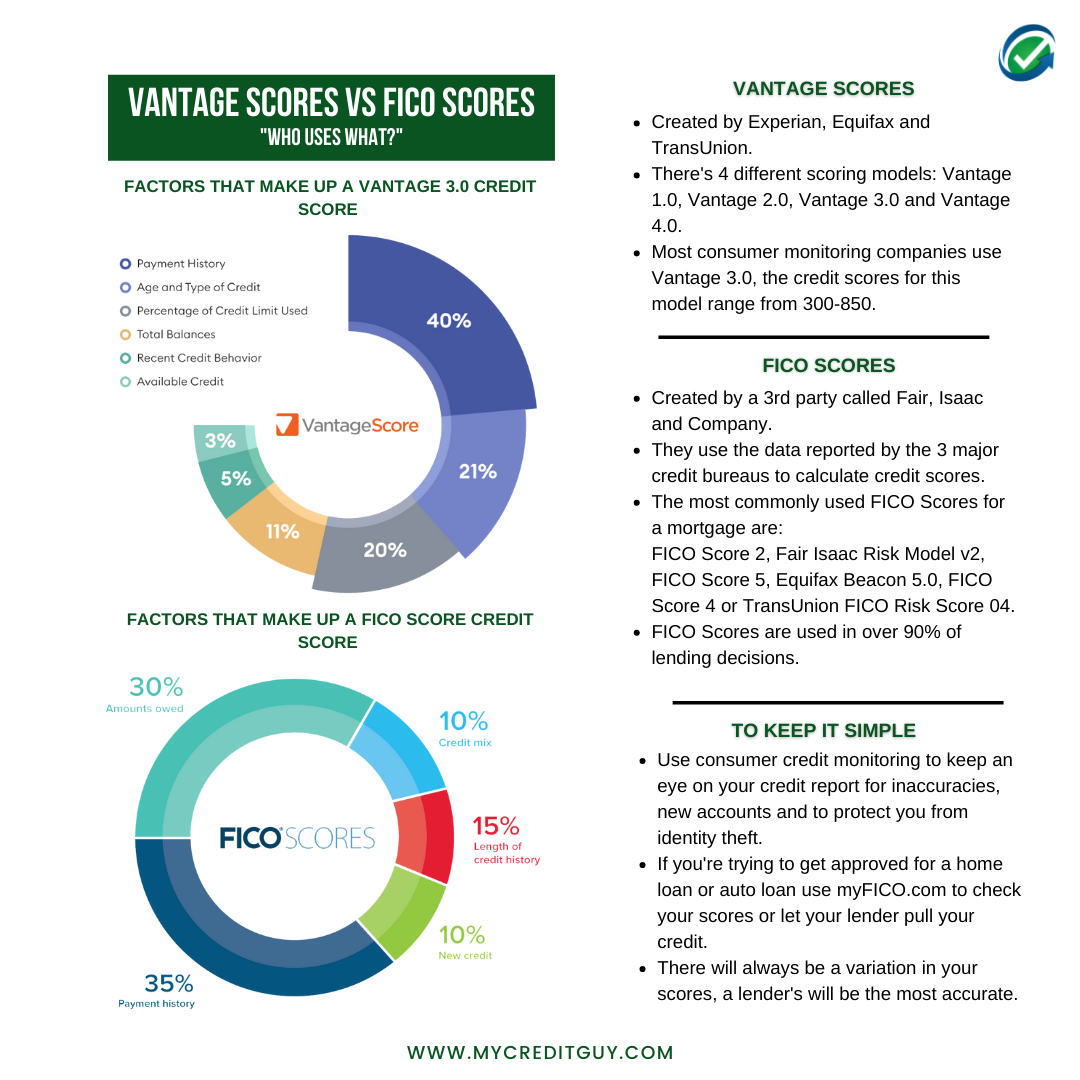

- VantageScore 3.0: Commonly used by credit monitoring apps like Credit Karma. It provides a general overview of your credit health but isn’t typically used for lending decisions.

- FICO Scores: Mortgage lenders rely on specific FICO scoring models, such as FICO Score 2, 4, or 5, which analyze credit factors differently than the VantageScore.

Why This Difference Matters

The score you see on your credit monitoring app might not reflect the factors lenders prioritize when evaluating your mortgage application. For example, mortgage-specific FICO scores place greater emphasis on payment history and the length of your credit history, while VantageScore may focus more on recent credit activity.

These differences can lead to a gap between the score you see and the one lenders use, which is why it’s crucial to understand the scoring model relevant to your financial goals.

Be Prepared for Your Loan Application

To avoid surprises when applying for a loan, it’s important to focus on the scores and factors mortgage lenders prioritize. The graphic below provides a helpful overview of the most commonly used credit scoring models and who relies on them, giving you a clearer understanding of what to expect.

We’re Here to Help

At Northeast Financial, we specialize in helping clients navigate the complexities of the mortgage process. If you have questions about your credit score or want to understand how it may impact your loan options, don’t hesitate to reach out. Contact us today, and let’s work together to make your financial goals a reality.

- by Northeast Financial

- on January 23, 2025