The Single Family Housing Guaranteed Loan Program is designed to assist households in obtaining adequate but modest, decent, safe and sanitary dwellings and related facilities for their own use in rural areas. Loans are limited to applicants with incomes that do not exceed state and local Rural Development (RD) median income limits and property that is designated as rural by RD.

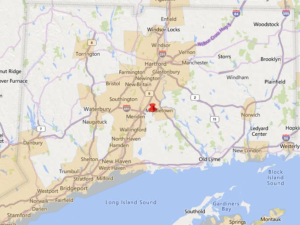

The white areas on the map below show just how much of Connecticut is eligible for USDA financing:

PROGRAM HIGHLIGHTS

- 620 Minimum qualifying credit score

- No down payment required

- Borrowers can finance up to 100% of the appraised home

value or a borrower can have a gift or grant go toward a

down payment with no money out of pocket - Competitive 30-year fixed interest rates

- Flexible credit guidelines

- No maximum purchase limit — The USDA Rural Development

program has no maximum purchase price limit - An applicant for the USDA mortgage guarantee loan must

provide sufficient income verification and a credit history

that indicates an ability and willingness to meet repayment

obligations - An individual or family must show proper legal capacity

to own property in the U.S.A., own no home or dwelling

currently, and have insufficient resources to qualify for a

conventional home mortgage

ELIGIBLE BORROWERS

- Individuals or families (who fall within the USDA income limits) who plan to occupy a home located in an eligible rural area as their primary residence may qualify for a USDA Rural Development home loan

CONTACT US TODAY TO LEARN MORE!